Let's break down one of the most fundamental metrics in the subscription world: SaaS Customer Acquisition Cost, or CAC. In simple terms, this is the total amount you spend on sales and marketing to bring in one new paying customer.

Think of it as the entry fee for winning new business. Getting a firm grip on this number isn't just a good idea—it's the bedrock of building a company that's both profitable and scalable.

Why SaaS Customer Acquisition Cost Is Your Most Important Metric

In SaaS, growth can be misleading. Seeing your user count climb is exciting, but it’s a vanity metric if the cost to get those users is higher than the revenue they'll ever bring in. That’s a fast track to burning through cash and going out of business.

This is exactly why your SaaS customer acquisition cost is your most critical health check. It cuts through the noise and reveals the true economic reality of your business.

Let’s go back to basics with a lemonade stand. Your CAC is the cost of the colorful signs, the flyers you handed out, and the time you spent convincing people to buy a cup. If you sell lemonade for $1 but it cost you $2 in effort and materials to attract that one customer, you’ve got a problem. The world of software is more complex, but the principle is identical.

The Foundation of Scalable Growth

Investors, founders, and marketing leaders live and die by this number because it informs their most important decisions. A low, stable CAC is a green light, signaling that your business model is efficient and primed for growth. On the other hand, a high or climbing CAC is a major red flag.

Understanding your CAC allows you to:

- Gauge Profitability: It shows you precisely how much you can afford to spend on acquiring a customer and still come out ahead over their lifetime with your product.

- Optimize Marketing Spend: By calculating CAC for each channel—like Google Ads versus content marketing—you can double down on what works and cut what doesn't.

- Forecast Future Growth: When your CAC is predictable, you can project how much growth a certain budget will buy you, which makes financial planning far more reliable.

At its core, CAC answers a simple but vital question: "Is our growth engine sustainable?" Answering this honestly is the first step toward building a business that lasts.

The Critical Link to Customer Lifetime Value

But here’s the thing: CAC doesn't tell the whole story on its own. Its real power is unleashed when you pair it with another essential metric: Customer Lifetime Value (LTV). LTV is the total revenue you expect to earn from a single customer over the entire time they use your service.

The relationship between these two metrics is everything.

Knowing you spent $300 to acquire a customer is just a number in a vacuum. Is that good or bad? You can't know until you find out whether that customer will ultimately pay you $100 or $1,000. The ratio of what you spend (CAC) to what you earn (LTV) is the ultimate stress test for your business model. We'll dive deeper into that crucial ratio later, but for now, just know that mastering your CAC is the first, non-negotiable step.

How to Accurately Calculate Your SaaS CAC

https://www.youtube.com/embed/VQqnT6xV-xk

Okay, let's move from theory to reality. Actually calculating your SaaS Customer Acquisition Cost is where the magic happens, and it's not as scary as it might seem. At its core, the formula is surprisingly simple, yet it gives you a powerful look into how efficiently your business is running.

The basic formula is: Total Sales & Marketing Spend ÷ New Customers Acquired = CAC

Looks easy, right? But the real trick—and where many people go wrong—is getting that "Total Spend" number right. A truly accurate CAC depends on being brutally honest about everything that goes into that figure.

What Really Goes into Your Total Sales and Marketing Spend?

To get a CAC you can actually trust, you need to add up every single cost tied to winning new customers over a set period, like a month or a quarter. This goes way beyond just your ad budget.

Here’s what you absolutely must include:

- Salaries: The full pay for your entire sales and marketing teams. Don't forget commissions and bonuses!

- Advertising Spend: This is the most obvious one—the direct cost for all your paid campaigns on Google, social media, sponsored content, you name it.

- Content Creation Costs: Did you hire freelance writers? A video editor? A designer? Those costs count.

- Software and Tools: Add up the subscription fees for your CRM, marketing automation platform, SEO tools, and any other tech your acquisition teams rely on.

- Overhead: A fair portion of general business costs that support sales and marketing, like office rent or utilities.

The whole point is to capture every single dollar you spent with the specific goal of acquiring new customers. If you leave out big-ticket items like salaries, you'll get a misleadingly low CAC and a dangerously false sense of security about your business's health.

A Practical Example with 'SyncUp'

Let's make this real. Imagine a fictional SaaS company called "SyncUp." They want to figure out their CAC for the last quarter.

First, they gather all their sales and marketing expenses:

- Team Salaries & Commissions: $60,000

- Google & LinkedIn Ad Spend: $25,000

- Marketing & Sales Software (CRM, etc.): $5,000

- Content & Design Freelancers: $3,000

- Total Quarterly Spend: $93,000

In that same three-month period, the SyncUp team brought in 300 new paying customers.

Now, they just pop those numbers into the formula:

$93,000 (Total Spend) ÷ 300 (New Customers) = $310

Boom. SyncUp’s CAC for the quarter is $310. They now have a solid number they can use to measure performance and make smarter decisions. To make this even easier and ensure you don’t miss anything, a dedicated Customer Acquisition Cost Calculator can do the heavy lifting for you.

Blended vs. Paid CAC: Getting a More Advanced View

For those who want to dig deeper, the next level is to separate your Blended CAC from your Paid CAC.

Blended CAC: This is what we just calculated for SyncUp. It’s the average cost across all new customers, no matter how they found you—paid ads, organic search, word-of-mouth, or by typing your URL directly.

Paid CAC: This is a much more focused metric. Here, you only count the marketing dollars spent on paid channels and divide that by the customers you acquired specifically from those channels.

Why bother with two numbers? Because the comparison tells a powerful story. It helps you see how cost-effective your advertising is.

If your Paid CAC is way higher than your Blended CAC, it's often a great sign. It means your organic channels are working hard, bringing in customers for "free" and showing you've built a strong brand. This kind of detailed analysis is a crucial part of knowing where to put your money. If you want to get into the weeds of assigning value to different channels, it's worth understanding what is marketing attribution and how that works.

Understanding SaaS CAC Benchmarks by Industry

So you’ve calculated your SaaS customer acquisition cost, and now a single number is staring back at you. Is a CAC of $310 a victory or a warning sign? The honest answer is: it's impossible to know without context.

A "good" CAC isn't a universal constant. It's a moving target that changes dramatically from one industry to the next. What might be a celebrated win in one sector could spell disaster in another. This is why industry benchmarks are the only reliable ruler for measuring your own performance.

Why Context Is King for CAC

Let’s paint a picture. Imagine two different SaaS companies. The first sells a simple, self-service project management tool for small teams at $20/month. The second offers a complex, enterprise-level fintech platform with a year-long sales cycle and an average contract value in the tens of thousands.

It’s obvious they won’t have the same acquisition cost, right? The project management tool might snap up customers for under $100 through smart content and SEO. Meanwhile, the fintech company could easily spend $1,500 or more per customer, leaning on a dedicated sales team and hyper-targeted advertising. Neither is inherently "better"—their CAC simply reflects the realities of their market.

Several key factors drive these industry-specific benchmarks:

- Market Competition: In a crowded space like CRM software, companies are all bidding for the same audience. This drives up ad costs and, you guessed it, the CAC.

- Sales Cycle Length: Enterprise software often involves long sales cycles with multiple demos and stakeholder approvals. This naturally racks up higher costs, mainly from the sales team's salaries and time investment.

- Ideal Customer Profile (ICP): Targeting massive enterprise clients demands far more resources and personalized outreach than acquiring small businesses or individual users.

- Product Complexity: If your product is highly technical and requires a lot of education and support during the sales process, your acquisition cost will be higher than a simple, plug-and-play tool.

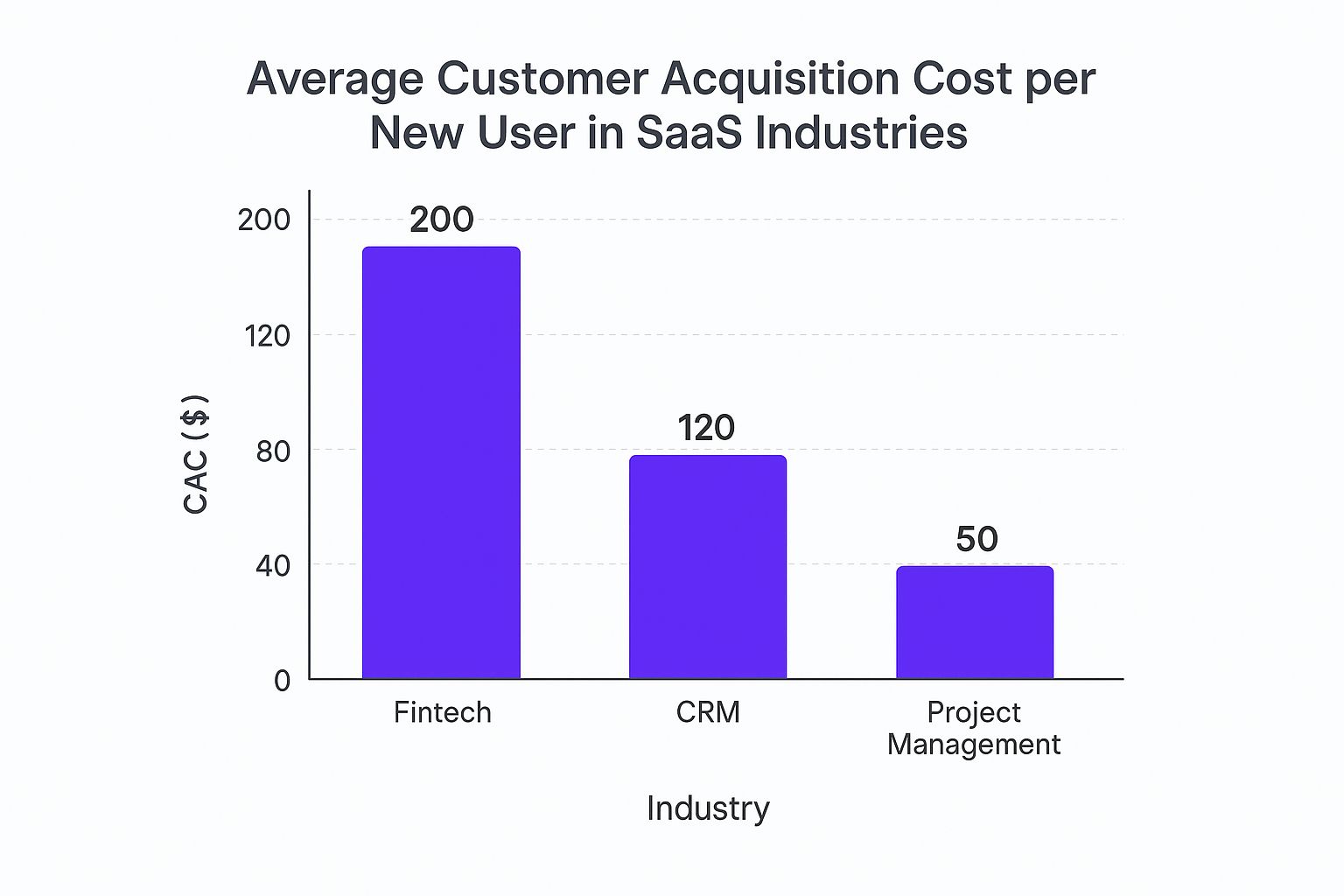

This infographic gives you a great visual breakdown of just how much SaaS customer acquisition cost can vary across different industries.

As you can see, a highly specialized field like Fintech carries a much heavier CAC than a more broadly applicable tool for project management.

Finding Your Place in the SaaS Landscape

Having a frame of reference is crucial for setting realistic goals. As of 2025, the average CAC for B2B SaaS companies sits around $536 per customer. But that average hides some wild variations. Fintech companies, for instance, are now spending an average of $1,450 to land a single customer. Insurance SaaS is not far behind at $1,280, and medtech firms are at $921. This is a world away from simpler niches, where a CAC can be as low as $400 for referral-driven growth. For a deeper dive into these numbers, the data from the We Are Founders UK website is an excellent resource.

The wide variation in average CAC across different B2B SaaS industries underscores why context-specific benchmarking is so important. A number that seems high in one niche might be perfectly normal in another.

Average B2B SaaS Customer Acquisition Cost By Niche:

- Fintech: $1,450

- Insurance: $1,280

- Medtech: $921

- General B2B SaaS (Average): $536

- Referral-driven Models: $400

This data clearly illustrates that your niche plays the biggest role in defining a "good" CAC. Comparing your performance against relevant industry figures is the only way to get a true sense of your efficiency.

Understanding where you stand relative to direct competitors is the first step toward real optimization. It helps you shift from asking, "Is my CAC good?" to "Is my CAC efficient for my specific market?"

Using Benchmarks to Guide Strategy

Knowing these benchmarks does more than just satisfy your curiosity—it empowers you to make smarter strategic moves. If your CAC is way higher than your industry average, that's a bright red flag. It’s time to dig into your sales and marketing funnel and find the leaks.

On the flip side, what if your CAC is much lower than the benchmark? Before you pop the champagne, consider what it might mean. It could be a sign that you're underinvesting in growth, leaving market share on the table for more aggressive competitors to grab. This might actually be your green light to scale up spending on the channels that are already working.

Ultimately, benchmarks provide the context you need to interpret your numbers correctly. They help you set achievable targets, justify your marketing budget, and figure out if your saas customer acquisition cost is a competitive advantage or an area that needs immediate attention.

The LTV to CAC Ratio: Your Key to Profitability

Knowing your SaaS customer acquisition cost is a great start, but it only tells you half the story. A $310 CAC is just a number floating in space. To figure out if that spending is actually building a healthy business, you have to compare it to the revenue each customer brings in over time.

This is where the LTV to CAC ratio comes in. It’s arguably the single most important metric for understanding if your SaaS company has a viable future.

LTV stands for Customer Lifetime Value, which is the total revenue you can reasonably expect to earn from a customer throughout their entire relationship with your product. When you put LTV and CAC side-by-side, you get a brutally honest look at your business model's profitability.

Calculating Customer Lifetime Value Simply

You don't need a complex financial model to get started. A straightforward formula using two metrics you should already be tracking will give you a solid LTV estimate.

The formula is: Average Revenue Per Account (ARPA) ÷ Customer Churn Rate = LTV

- Average Revenue Per Account (ARPA): This is just the average revenue you get from each customer, usually on a monthly or annual basis.

- Customer Churn Rate: This is the percentage of customers who cancel their subscriptions in a given period. It's the silent killer of many SaaS businesses.

Let's jump back to our example company, SyncUp. They know their ARPA is $50 per month, and their monthly customer churn rate is 4%.

Here’s their LTV calculation: $50 ÷ 0.04 = $1,250

So, on average, SyncUp can expect to make $1,250 from each customer before they eventually cancel. Now they have the other half of the puzzle.

Interpreting the LTV to CAC Ratio

With both LTV and CAC in hand, you can finally pop the hood and see how the economic engine of your business is running. For SyncUp, we have:

- LTV: $1,250

- CAC: $310

The LTV to CAC ratio is $1,250 : $310, which simplifies to roughly 4:1. What does this mean? For every dollar SyncUp spends to get a customer, they can expect to get four dollars back over that customer's lifetime. Not bad at all.

The LTV to CAC ratio is your business's report card. It tells you whether you're investing your money wisely to create sustainable growth or just burning cash to acquire unprofitable users.

This ratio gives you immediate, actionable insight into your company’s health. Different ratios tell very different stories about your future. For more details on tracking this and other vital figures, explore our guide on key marketing performance metrics.

The Gold Standard for SaaS Growth

So, what does a "good" ratio even look like? While every business is unique, the SaaS world has some widely accepted benchmarks that signal whether you're on the right track or heading for trouble.

- 1:1 Ratio: This is a huge red flag. You're spending a dollar to make a dollar. Once you account for other business costs like R&D and support, you’re actually losing money on every single customer you sign up.

- 3:1 Ratio: This is widely seen as the "gold standard" for a healthy, growing SaaS business. It proves you have a profitable acquisition model and a product sticky enough to keep customers around long enough to make a great return.

- 5:1 Ratio or Higher: This looks incredible on paper, but it can sometimes point to a different kind of problem: you might be underinvesting in growth. A super high ratio could mean you're being too conservative and missing out on opportunities to grab more market share.

The old rule of thumb for SaaS profitability was a 3:1 LTV to CAC ratio—never spend more than a third of a customer's lifetime value to get them. But things have gotten more competitive. The median SaaS firm now spends $2.00 in sales and marketing to generate $1.00 in new annual recurring revenue, with the least efficient spending a staggering $2.82 to earn that same dollar.

SyncUp's 4:1 ratio puts them in a fantastic position. Their business is clearly profitable, and it suggests they have room to invest more aggressively in marketing to grow even faster without putting the company's financial health at risk. This simple ratio turns CAC from a boring expense line into a powerful, strategic tool for growth.

Actionable Strategies to Reduce Your SaaS CAC

Knowing your SaaS customer acquisition cost is one thing, but actually doing something about it is where the real work begins. The goal isn't just to slash your marketing budget; it’s about getting smarter with every dollar you spend to get a better return.

Think of it as a playbook of proven tactics. These strategies are all about boosting efficiency at every single stage of the customer journey, from the moment they first hear about you to the moment they sign up. By fine-tuning your approach, you can bring in more high-value customers for less money, which directly pumps up your LTV:CAC ratio.

Let's dig into the key areas where you can make a real impact.

Fine-Tune Your Acquisition Channels

Let's be honest: not all marketing channels are created equal. Some will be incredible growth engines, while others are just budget-draining black holes. The secret is figuring out which is which and doubling down on what works.

Start by getting granular. You need to track the CAC for every single channel—your Google Ads, content marketing, LinkedIn campaigns, you name it. This microscopic view will show you exactly where your best customers are coming from and what they're costing you. If you discover that organic search consistently brings in customers for $150 while a paid social campaign is costing $500 a pop, the next move becomes pretty obvious.

This doesn't mean you have to kill all your paid channels. Instead, it’s a signal to investigate. Is your ad creative falling flat? Is your targeting way too broad? By pausing what's clearly not working and funneling that cash into your proven performers, you can lower your overall CAC almost immediately without losing momentum. For a closer look at specific methods, there's a great guide with proven strategies to reduce customer acquisition cost.

The goal isn't just to spend less; it's to get more from every dollar spent. By treating your marketing budget like a strategic investment portfolio, you can maximize returns and build a more resilient growth model.

Improve Your Funnel Conversion Rates

Getting a customer is a multi-step journey, and every point of friction is a chance for a potential buyer to walk away. The good news is that even tiny improvements at each stage of your sales funnel can have a huge domino effect on your final SaaS customer acquisition cost.

Think of your funnel as a leaky bucket. Every leak you plug means more water—or in this case, more customers—makes it to the bottom.

Here are a few high-impact places to start patching those leaks:

- A/B Test Your Landing Pages: Never stop testing. Tweak your headlines, your calls-to-action (CTAs), your images, and even the length of your forms. A simple change, like rewording a button, can sometimes boost conversions by 10-20% and directly slash your cost per lead.

- Simplify Your Onboarding Flow: A clunky, confusing onboarding process is a guaranteed way to lose trial users. Your number one job is to get them to their "aha!" moment—that magical point where they truly get your product's value—as fast as humanly possible.

- Optimize Your Pricing Page: This is often the final hurdle. Make sure your pricing tiers are crystal clear, the value is undeniable, and the checkout process is dead simple.

Every improvement you make means you need fewer visitors at the top of the funnel to get one paying customer at the bottom. That's a direct win for your CAC.

Adopt Product-Led Growth Strategies

Product-Led Growth (PLG) is a game-changer. It's a whole philosophy that puts your product at the center of your growth strategy—making it the main tool for acquiring, converting, and retaining customers. Instead of relying on expensive sales teams to tell people how great your product is, you let the product show them.

This approach completely flips the acquisition cost model on its head.

The most popular PLG plays are freemium plans and free trials. By offering a free-forever version with limited features or a time-boxed trial of the full-fat product, you remove all the friction. Anyone can sign up and start seeing value without talking to a salesperson or pulling out a credit card.

What happens next is magic. A huge chunk of these users will convert themselves into paying customers once they hit a usage limit or need a premium feature. This self-serve model drastically cuts your dependence on a hands-on sales process, especially for your smaller accounts.

For a deeper dive, our guide on effective SaaS lead generation strategies explores how PLG fits into a broader, efficient customer acquisition plan.

Build a Powerful Customer Referral Engine

What's better than getting a new customer for $300? Getting one for a tiny fraction of that because an existing, happy customer brought them in. Word-of-mouth isn't just a nice-to-have; it's one of the most cost-effective and powerful acquisition channels you can build.

Customers who come from referrals are often the best kind. They tend to stick around longer and have a higher LTV because they arrived with built-in trust. The trick is to turn random, one-off referrals into a predictable, scalable growth machine.

Here's how to build a referral program that actually works:

- Identify Your Advocates: Start by finding your biggest fans—the users with high engagement rates or glowing feedback.

- Make It Easy to Refer: Give them a unique referral link they can share with one click. Remove every possible obstacle from the process.

- Offer a Compelling Incentive: Make it a win-win. Reward both the person referring and the new customer they bring in. This could be a discount, account credits, or early access to a new feature.

When you empower your best customers to become your best marketers, you create a low-cost acquisition loop that feeds itself, driving down your blended SaaS customer acquisition cost for the long haul.

Got Questions About SaaS CAC? We've Got Answers.

As you start digging into customer acquisition costs, a few common questions always seem to pop up. Let's tackle some of the most frequent ones to help you get a clearer picture of how to apply these concepts to your own business.

What Is the CAC Payback Period and Why Does It Matter?

Think of the CAC payback period as your break-even point on a new customer. It’s the exact number of months it takes to earn back every dollar you spent to get them in the door.

This metric is a direct measure of your company's efficiency. A shorter payback period means you get your cash back faster, which you can then reinvest into acquiring the next customer. For most SaaS companies, the sweet spot is keeping this under 12 months.

When your payback period stretches too long, it puts a serious strain on your cash flow. It’s one of the first things savvy investors look at to gauge the health and scalability of your business.

How Often Should I Calculate My SaaS CAC?

There's no single right answer, but a great rhythm is to calculate your SaaS customer acquisition cost both monthly and quarterly. Each timeframe tells you something different.

- Monthly calculations are perfect for tactical adjustments. They give you a quick read on how a new ad campaign or a recent sales experiment is performing right now.

- Quarterly calculations smooth out the monthly bumps and give you a more strategic, high-level view. This helps you understand your true acquisition efficiency without getting thrown off by a single good or bad month.

Can My CAC Ever Be Too Low?

It sounds counterintuitive, but yes, it's possible. While a low CAC is usually a goal worth celebrating, an exceptionally low CAC can be a red flag for a missed opportunity.

If you see a sky-high LTV to CAC ratio—think 5:1 or more—it might actually mean you're not investing enough in growth. You could be leaving market share on the table for a more aggressive competitor to snap up. It's a sign that you might have room to thoughtfully increase your sales and marketing spend to capture more of the market.

Ready to turn your speaking engagements into a predictable lead generation engine? SpeakerStacks helps you capture audience interest in real-time, measure event ROI, and fill your pipeline. Stop letting potential leads walk out the door—start converting them with a branded, frictionless experience. Learn more about SpeakerStacks and get started.

Related Articles

Want More Insights?

Subscribe to get proven lead generation strategies delivered to your inbox.

Subscribe to Newsletter